The transfer charges that Indians abroad pay to send money home are very high, and the Indian alternative to SWIFT will help reduce them sharply

By Kumud Das

The National Payments Corporation of India (NPCI), the company that built India’s digital payments backbone United Payments Interface (UPI) platform, plans to make it cheaper and easier for the nation’s 32 million expatriates to bring their money home by building a home-grown alternative to SWIFT (Society for Worldwide Interbank Financial Telecommunication), the Belgium-based cross-border payment system.

At present, remittance costs $13 on average to send $200 across borders, which makes the job of sending money home expensive for Indians living abroad. In fact, the UN Member-States have pledged, in the Sustainable Development Goals (SDGs), to reduce the cost of remittance from an average of 7 percent to less than 3 percent by 2030. And the effort being made by NPCI is very much in that direction.

Once the NPCI’s home-grown alternative to SWIFT becomes operational, this cost is likely to nosedive and give a boost to inbound remittances.

Indians overseas remitted $87 billion last year, the biggest inflow for any country tracked by the World Bank. The remittances market is ripe for disruption, according to Ritesh Shukla, chief executive officer of NPCI International Payments Ltd.

“We have displaced cash in India to a large extent and are now looking to repeat the success in cross-border corridors,” said Shukla, adding, “Overseas Indians can use our rails to remit money inwards straightway into their bank accounts and for the markets where Indians travel frequently, we will build acceptance for our instruments.”

The very objective was not to displace existing platforms. About 330 banks and 25 apps― including Alphabet Inc’s Google Pay and Meta Platform Inc’s WhatsApp―share NPCI’s unified payment interface, which has helped make instantaneous digital transactions a $3 trillion market in India.

NPCI is in the process of connecting the UPI platform to systems in other countries to replicate its domestic success. “The UPI integration will be a big step in that direction,” says Mayank Goyal, CEO of moneyHop, a cross-border banking app that lets users make international remittances through the SWIFT network.

The cost of cross-border remittance, Goyal said, is higher primarily due to involvement of several intermediaries in the payment chain. With the integration of UPI with the real-time payment systems across various jurisdictions, the role of these intermediaries will reduce and hence the cost of cross-border remittances will also come down.

According to Goyal, “UPI will certainly help in aligning the real-time payment systems across the globe and will help in reducing not just the cost of the remittance but also the processing time. It has the ability of a pioneering project for governments globally to make the various payments systems interoperable.”

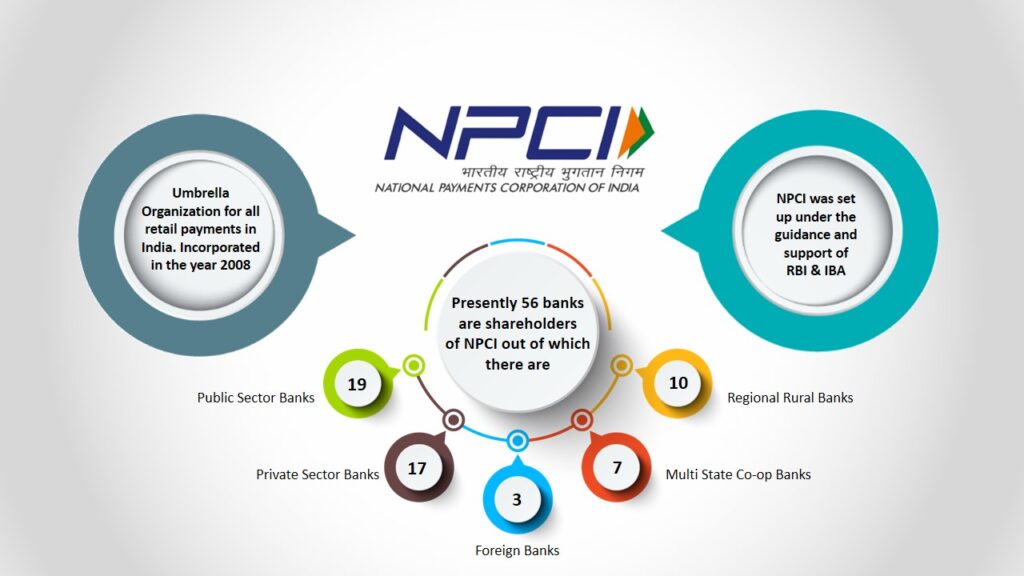

The Reserve Bank of India (RBI) set up NPCI along with the country’s lenders to make retail payments faster, more accessible, and cost-efficient. A user just needs a virtual payment address to instantly transact with vendors and exchange cash between friends or family members.

The size of the outbound remittance market from India under LRS (Liberalised Remittance Scheme) stands at roughly $18-$20 billion with the studies abroad, travel, maintenance of close relatives and gift segments contributing the most to the overall market. This market has been growing at roughly 30 percent year-on-year excluding 2020, owing to the pandemic. There was a dramatic jump in 2015 and 2016 due to the change in the regime where the outbound remittance limit increased from $75,000 to $250,000 over a few remittances. The inbound market stands at $88 billion. This market has been growing at 6-8 percent.

As per Michel D. Patra, deputy governor, RBI, India is likely to contribute about 14 percent of global growth in 2022, making it the second most important driver of global growth after China. Moreover, India’s GDP at market exchange rates is expected to reach $5 trillion by 2027 and $10 trillion by 2032.

Now, the moot question arises: why should one invest in India?

Analysts believe that the most attractive aspect of investing in India is the outsized alpha opportunity that the Indian market presents when compared to any other equity market globally. The return from the Indian stock market during the past decade is 14 percent in INR and 11 percent in USD.

This makes India one of the favourable investment destinations both for Indian and NRI investors. The assets under management (AUM) of the mutual fund industry have seen a nearly four-fold rise from ₹10 trillion in May 2014 to ₹37.77 trillion at the end of July 2022.

At a time when there is talk of doom and gloom with the developed world fighting record inflation and the spectre of recession looming, India is poised to emerge as the fastest growing economy.

“Investors should seriously consider investing in India to leverage the compelling secular Indian growth story and attractive risk adjusted return,” says Dr Nirakar Pradhan, chief executive officer, PRMIA India.

According to Pradhan, equity must be a part of any NRI’s investment portfolio in India considering the unique drivers behind the Indian economy and market, including:

- Strong domestically driven growth profile

- Profitable and diverse corporate universe

- Institutional infrastructure of a mature democracy

- Transparency and ease of access to capital markets

- Structural reforms grounded on digitalisation of transactions and financialisation of assets

- Simplified and attractive tax system with only a 10 percent rate on capital gains from stocks exited within one-year holding period. Similarly, for bond investors, India provides attractive risk-free rates of nearly 7 percent and capital gains tax of 20 percent after factoring in inflation index.

It is said that the 19th century belonged to Europe, the 20th century to the US, and the 21st century is likely to belong to Asia.

Going by a paper from the Economist Intelligence Unit (EIU), the Russian invasion of Ukraine will cause disruption of the cross-border payment systems and could, in conjunction with technological advances, challenge the dominance of the SWIFT network.

SWIFT, the study notes, has “encountered criticism for its relative inflexibility and lack of transparency” and seen a decline in the number of correspondent banking relationships over the past decade.

Of late, Russia has been excluded from the SWIFT network, a move which could see the country and others such as China and India double up regarding their nascent SWIFT alternatives.

Nevertheless, the paper says, “setting up and scaling a full-fledged alternative bank-messaging system would be expensive and time consuming. It would also have limited real-world impact, given the prevalence of dollar-denominated cross-border flows. SWIFT will remain the dominant network, as long as countries and lenders come together to improve the Belgian network.”

In its Payments Vision 2025 document, the RBI said that Structured Financial Messaging Solution (SFMS) could provide faster, convenient and cost-effective direct payment channels with other jurisdictions.

Separately, cross-border payments will be disrupted by government-backed efforts to link systems. In Asia, moves are already underway to do this, allowing travellers across the region to purchase goods and services by scanning QR codes.

(The writer is a senior Mumbai-based journalist.)